Investing for your retirement

An introduction to investing

When you put money into your pension whether it's every month or as a lump sum, your contributions go into a pension "pot", which is then invested to help it grow over time.

Once you've decided how you want your pension to be invested, a fund manager will be responsible for managing your investment in a range of funds. They can spread this money throughout a range of funds based on different groups of investment types - known as asset classes - such as property, shares, or bonds.

Once your money is invested, the fund manager will continue to closely monitor and manage the funds in line with their investment objective.

Our investment philosophy

Our key goal is to deliver the best possible outcomes for you. We do this by understanding your investment needs as agreed by you with your Financial Broker, and by keeping to our core beliefs.

Strong Governance

We believe that all investment options should be monitored on a regular basis and that through strong governance we can help make sure they aim to deliver in line with their objectives. That's why all our investments have a formal review process which includes regular meetings with our fund managers to make sure investment decisions are made in your best interest.

Customer focused investment proposition

We believe the main driver behind designing investment propositions should be delivering positive customer outcomes.

Responsible investing

We work closely with the fund managers managing your investments, including Royal London Asset Management and BlackRock, where possible to embed our responsible investment principles. As a minimum, we ask all our fund managers of our actively managed funds to consider ESG factors in their investment decision-making.

Value for money

At the heart of our investment proposition is the aim to deliver value for money to our customers. We believe that by managing fees and costs and ensuring efficient implementation we can prevent unnecessary cost where possible. We also aim to be as transparent as possible in our reporting of how your investments are doing which you can access through our fund factsheets, quarterly reports on our Fund Centre.

Helping you invest with confidence

Investing can be confusing, but it can really help you achieve the savings goals you want, for the future you want. We offer a full range of investments with flexibility so you can decide on the right mix for you - helping you balance both risk and reward. You can see below some of the investment options such as ready-made Multi-Asset funds and Sustainable funds as well as more about the full fund range that we offer.

Take some advice

If you're looking to make the most of your pension savings or if you need help deciding on a suitable investment option, we'd recommend that you talk to a Financial Broker.

Our Risk Scale

Understanding the risk

Decide how much risk you want to take

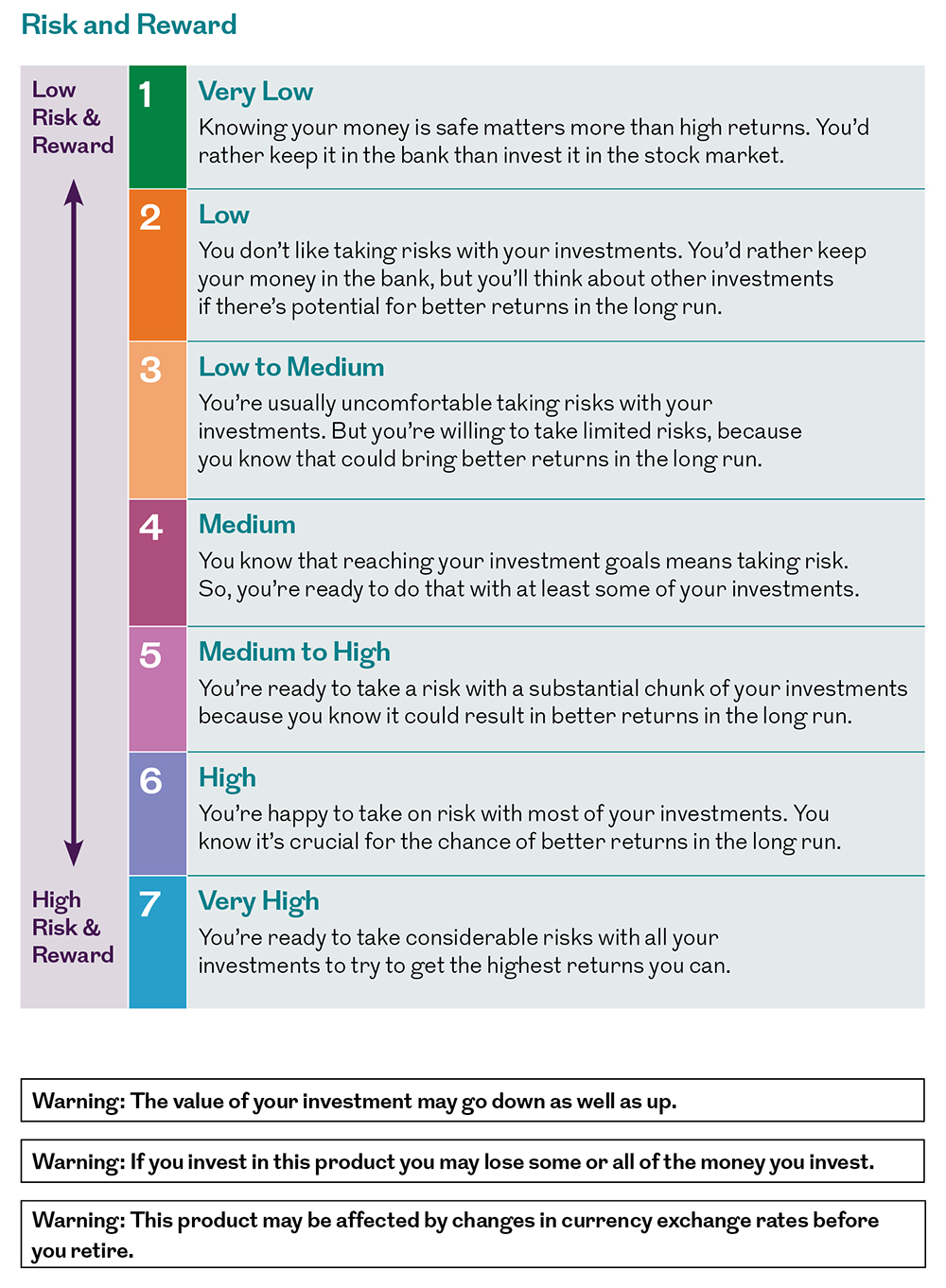

The more risk you’re willing to take with your investments, the higher your potential investment return – but the greater your chance of loss. Lower risk investments, on the other hand, offer greater security but with lower potential investment returns. You need to decide how much risk you want to take with your pension savings.

How you feel about risk is one of the most important parts of selecting the right investments for you. Some people are very comfortable taking risks, while others don’t like it at all. We’ve come up with different ways to invest outlined in our Risk Scale graphic, so you can find a level of risk you’re comfortable with. Maybe you already know where you sit on this scale. But even if you do, we’d still suggest talking to your Financial Broker to make sure.

Risk Profiles

Your Financial Broker can take you through the Royal London Ireland Risk Profiler online. This can help you understand more about investment risk and what levels of risk you feel comfortable with.

Once you answer the risk profiler questions, you’ll be categorised into one of seven risk profiles. You can then choose investments that match your risk profile.

More about our funds

Fund Centre

Find out more about our fund range, performance and factsheets

Fund Guide

Learn more about our funds with this helpful guide.

Guide to Flexible Lifestyle Strategies

Learn more about our flexible lifestyle strategies available to our Personal Retirement Bond customers.

Take some advice

We’re big believers in the value of impartial advice to help you enjoy the best possible retirement outcomes. So, if you’re looking to make the most of your pension savings, we’d recommend talking to a Financial Broker.

If you don't already have one, you can find one here.

Ring our Dublin team

for more information:

01 429 3333

Monday to Friday: 8am - 6pm

We recommend discussing your retirement options with your Financial Broker.

They’ll be able to look at your individual circumstances and give you a personal recommendation on how to get the most from your pension savings.

Our Helping Hand service

Helping Hand gives one-to-one personal support from your own dedicated nurse from RedArc who can help you and your family cope with the devastating effects that illness or bereavement can have.

More about Helping Hand

| Warning: The value of your investment may go down as well as up. |

| Warning: If you invest in this product you may lose some or all of the money you invest. |

| Warning: Past performance is not a reliable guide to future performance. |

| Warning: The income you get from this investment may go down as well as up. |

| Warning: These products may be affected by changes in currency exchange rates. |