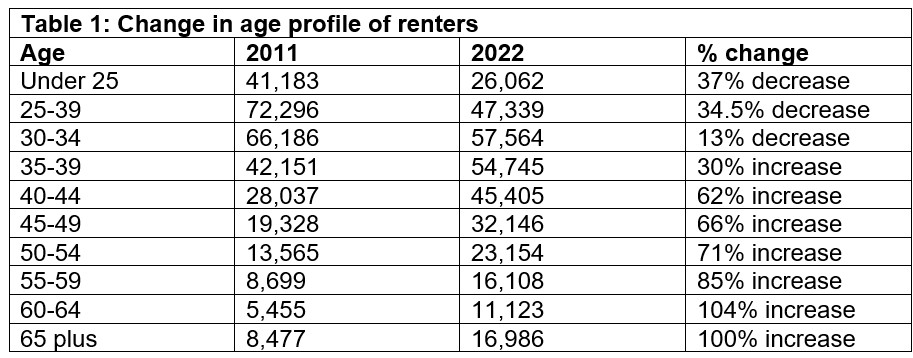

Twice as many people aged 65 and over are renting from private landlords today compared with 2011, while more people in their 40s, 50s, and early 60s are renting than ever before. Royal London Ireland, based on its analysis of market data, warns that soaring rents and the rise in older renters are leaving an increasing number of Irish households financially exposed in the event of an unexpected illness or life shock.

Experts at Royal London Ireland, one of Ireland’s leading life insurance and pensions companies, say that the later age profile of renters means that more people are starting or already have families while renting today, and many are doing so without the kinds of financial protections that would be put in place if they were buying a home.

Given the average monthly rent for a two-bedroom apartment nationwide is now €2,080 (€24,960 annually) and that market rents are now on average two-thirds (67%) higher than their Celtic Tiger peak[1], rents are a considerable financial burden for households and a bill they could struggle to pay in the event of a serious illness, injury, death or redundancy in the family.

In the past, homeownership came much earlier in life. In 1991, the age which marked the changeover between renting and home ownership was 26[2]. This increased to 27 years in 2002, 28 years in 2006, 32 years in 2011, 35 years in 2016 and 36 in 2022.

Barry McCutcheon, Protection Proposition Lead, Royal London Ireland, explained:

“Homeownership used to occur much earlier in life, but rising house prices and a chronic housing shortage mean many now rent well into their 30s and beyond. This shift has significant financial implications. Unlike homeowners, renters lack built-in protections and face greater insecurity if their landlord decides to sell, increasing their vulnerability.

“As life cover is a requirement when getting a mortgage, the families of homeowners with a mortgage are protected if the breadwinner dies. Renters may not have the same safety net, leaving their families financially exposed if the worst was to happen. Renters also have little if any security of tenure if their landlord decides to sell and this adds to their financial vulnerability.

“While the decision to buy or rent can be a lifestyle decision as much as a financial one, the reality is that rising house prices and the chronic shortage of housing in Ireland means that many people cannot afford or source a suitable home to buy. People are now renting much later in life than was previously the case and this has knock-on financial consequences.”

Royal London Ireland has highlighted several worrying trends that are increasing the financial vulnerability of renters:

- Market rents are on average 33% above their pre-Covid levels and 67% above their Celtic Tiger

peak[3] - Rental inflation remains steady, with Daft.ie reporting a 4.3% year-on-year increase consistent with the rate of inflation since late 2023[4].

- There was a 35% increase in eviction notices issued to tenants by landlords in the third quarter of this year when compared to the same period in 2024, with 61% due to landlords selling properties[5]. Small landlords leaving the market could push the number of eviction notices higher.

- The number of available rental homes has dropped to just 1,901, down 21% on the same time last year[6].

- The number of renters aged 65+ doubled between 2011 and 2022, while those in their 40s-60s also saw large increases (see Table 1 in Appendix).

- Over one in ten (13.3%) of renters aged 65+ are at risk of poverty[7].

Royal London Ireland is advising renters, particularly those with children or approaching retirement, to take steps now to reduce their financial vulnerability. This could include building an emergency fund, reviewing household budgets, and ensuring adequate protection is in place in the event of unexpected illness, injury, death, or other life events.

Mr. McCutcheon concluded,

“Renters should consider how they would manage financially if faced with a sudden setback. Talking to a Financial Broker could be a good first step in building financial resilience and ensure greater security for the future.”

- ENDS -

[1] As per Daft Irish Rental Report Q3 2025

[2] As per CSO Census of Population 2022 Profile 2 - Housing in Ireland

[3] As per Daft Rental Report Q3 2025, pg 8

[4] As per Daft Rental Report Q3 2025, pg 8

[5] As per Residential Tenancies Board Quarterly Update Q4 2025

[6] As per Daft Rental Report Q3 2025, pg 4

[7] As per CSO’s Survey on Income and Living Conditions (SILC) 2024

The table shows the age profile of the head of the household where the property is being rented from a private landlord.

Source: Census 2022 – Profile 2, Housing in Ireland - Figure 3.2

About Royal London Ireland

Royal London Ireland has a history of protecting its policyholders and their families, and it is committed to continue to do so for a long time to come. Our heritage in Ireland is 190 years starting when the Caledonian Insurance Company's first office opened on York Street, Dublin 2 in 1834. Today, Royal London Ireland is owned by The Royal London Mutual Insurance Society Limited – the UK’s largest mutual life insurance, pensions and investment company, and in the top 30 mutuals globally*, with assets under management of €211 billion, 8.6 million policies in force and over 4,800 employees. Figures quoted are as at 30 June 2025.

Royal London Ireland’s office is based at 47-49 St Stephen’s Green, Dublin 2.

*Based on total 2022 premium income. ICMIF Global 500, 2024