- Over 90% of people underestimate the monetary value of a stay-at-home parent – by approximately €24,000

- Less than one in ten believe that it would cost more than €50k to employ someone to carry out the duties of a stay-at-home parent

- Women are more likely to accurately estimate the value of stay-at-home parent duties

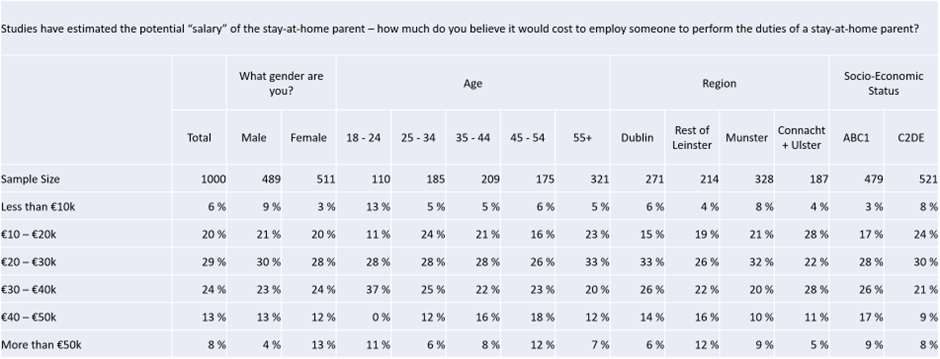

More than nine in ten people (92%) in Ireland underestimate the monetary value of stay-at-home parents to varying degrees. This is according to findings from the annual Stay-at-Home Parent Survey commissioned[1] by Royal London Ireland, one of the leading life insurance and pensions companies in Ireland. Of the 1,000 adults surveyed, only 8% valued the cost to employ someone to perform the duties of a stay-at-home parent at over €50k.

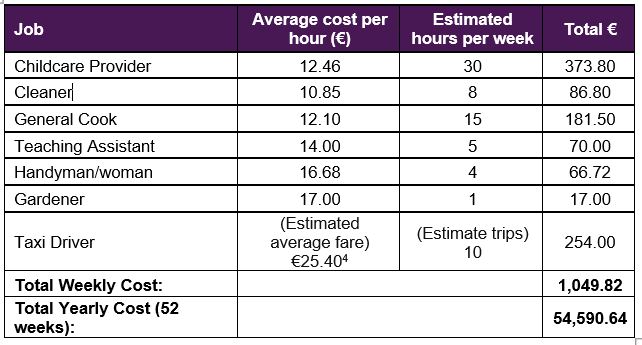

Royal London Ireland compared the survey findings with their own research into the financial value attributed to the various ‘jobs’ carried out by a parent who works in the home. Survey participants estimated the potential salary of a stay-at-home parent at an average of €30,547 in 2023 – an increase of €2,087 or 7.3% compared to 2022. However, Royal London Ireland’s research, which is based on real-world wage data, found that, in reality, the cost to employ someone to do the ‘duties’ performed by stay-at-home mams and dads would be an estimated €54,590 per annum - up from €53,480 in 2022.

Three times as many women as men who took part in the survey correctly estimated that it would cost more than €50k (13% vs. 4%).

Karen O’Flaherty, Senior Propositions Executive of Royal London Ireland commented:

“Each year we ask the same question to survey respondents and each year we’ve found that most people underestimate the likely ‘salary’ of a stay-at-home mam or dad. This year, survey participants estimated the potential ‘salary’ of the stay-at-home parent at an average of €30,547 per year, which is well below the €54,590 that we calculated for the role. While the role of the stay-at-home parent is often described as ‘priceless’, it is interesting to see how some people can misconceive the role of a stay-at-home parent and the financial cost.”

Other highlights from the Royal London Ireland Stay-at-home Parent Survey include:

· Almost a third of people (29%) estimated the wage to be between €20k and €30k, while one-fifth (20%) believed it to be as low as €10k to €20k.

· Three times the number of men (9%) as women (3%) said it would cost less than €10k

· The largest cohort to accurately estimate the salary of a stay-at-home parent were those aged between 45 and 54, with 12% of those in that age cohort valuing it at over €50k, perhaps indicative of those who have raised their own children.

· Those living in Leinster (outside of Dublin) placed the greatest value on the role of a stay-at-home parent with almost three in ten (28%) assessing their salary at above €40k.

· The majority of people (79%) estimated the stay-at-home parent’s equivalent salary to be €40k or less[2].

· Just under a quarter of respondents (24%) valued the salary of a stay-at-home parent to be between €30k and €40k.

The Costs

As part of its yearly assessment, Royal London Ireland examined the typical ‘everyday’ duties carried out by stay-at-home parents and researched the cost of employing someone to do these jobs using live wage data[3]. The duties included cooking, cleaning, chauffeuring children to activities, and so on. Royal London Ireland’s calculations reveal that the estimated annual cost to employ someone to fulfil these stay-at-home parent duties is €54,590.

[1] Conducted by iReach Ireland

[2] See Appendix

[3] Payscale.com Ireland - Research Job Salaries

Ms. O’ Flaherty remarked:

“The work done by stay-at-home parents is often referred to as “invisible labour” because it takes place within the home and is not as visible or measurable as paid work outside the home. Interestingly, our evaluation of what it would cost to employ someone to perform the duties of a stay-at-home parent was 79% greater than the salary estimated by our respondents at €30,547. That highlights just how many people may not be fully aware of the multifaceted responsibilities made by stay-at-home mams and dads.

“It’s understandable that, without doing the calculations, many people, particularly those without children, may not accurately estimate what the cost would be to replace the stay-at-home parent. An accurate evaluation of this cost, from a financial planning perspective, is an important figure to contemplate by every family. If something were to happen to a stay-at-home parent, stopping them from be able to carry out this vital role, or if they were to pass away unexpectedly, their loved ones could be left with a large financial gap to fill during what would already be a very difficult time. And while money can never replace a parent, having adequate financial protection in place can help provide families with a financial safety net to meet some of these parenting costs.

“Speaking to a Financial Broker will help people to understand how much and what type of financial protection they might need.”

Ends

Royal London Ireland Stay-at-Home Parent Survey 2023

Question asked: How much would you believe it would cost to employ someone to perform the duties of a stay-at-home parent?

About Royal London Ireland

Royal London Ireland has a history of protecting its policyholders and their families in Ireland, and recently launched a new Pensions business in Ireland. Our businesses heritage in Ireland is nearly 200 years. The Caledonian Insurance Company's first office outside Edinburgh opened on Dame Street, Dublin 2 in 1824. Today, Royal London Ireland is owned by The Royal London Mutual Insurance Society Limited – the largest mutual life insurance, pensions and investment company in the UK, with assets under management of €166 billion, 8.7 million policies in force and 4,200 employees. Figures quoted are as at 31 December 2022.

Royal London Ireland’s office is based at 47-49 St Stephen’s Green, Dublin 2.